How to File Your Tax Return and Maximize Your Refund This Year

How to File Your Tax Return and Maximize Your Refund This Year

Blog Article

Discovering the Benefits of Filing a Tax Return: Optimize Your Tax Obligation Refund This Year

Filing a Tax return is frequently perceived as a challenging task, yet it plays an essential duty in improving your monetary standing. By methodically reporting income and leveraging offered reductions and credit ratings, individuals can touch into the potential for significant tax reimbursements.

Significance of Declaring a Tax Return

Filing a Tax return is a considerable responsibility for people and companies alike, as it offers both compliance and economic administration purposes. Sticking to tax obligation regulations is vital, as falling short to file can cause considerable charges, rate of interest fees, and possible legal effects. By sending a Tax return, organizations and individuals show their commitment to meeting their public obligations and add to the functioning of public solutions.

In addition, submitting an income tax return offers an opportunity for taxpayers to assess their economic situation. It allows them to track earnings, expenditures, and general monetary wellness, which can notify future budgeting and investment decisions. For numerous, tax obligation returns are an entrance to potential refunds, as overpayment of taxes throughout the year can be recovered, supplying a much-needed financial increase.

In addition, the tax obligation return process can promote accessibility to numerous economic product or services. Lenders commonly require income tax return when identifying creditworthiness for financings or home mortgages, making it crucial for people and organizations looking for monetary help. Finally, submitting a Tax return is not merely a regulatory commitment; it is a substantial action in keeping financial stability and exposing potential advantages.

Recognizing Tax Obligation Reductions

Tax deductions are frequently overlooked yet play a crucial function in decreasing taxed earnings and optimizing prospective reimbursements. Recognizing the different sorts of tax reductions offered can significantly affect your general tax obligation responsibility. Deductions can be classified into two main types: itemized reductions and common deductions.

The criterion reduction is a set dollar amount that taxpayers can deduct from their revenue, varying based on declaring status. For lots of people, specifically those without considerable itemizable expenditures, taking the common deduction is useful. On the various other hand, itemized reductions allow taxpayers to list eligible expenses, such as home mortgage interest, clinical expenses, and charitable contributions, possibly yielding a greater deduction than the typical choice.

It's essential to keep careful documents of all insurance deductible expenditures throughout the year to ensure you record every eligible deduction. In addition, details deductions may undergo limitations or phase-outs based upon revenue levels. Acquainting yourself with these nuances can aid you strategically intend your finances and optimize your tax return. By leveraging and recognizing tax obligation deductions properly, taxpayers can decrease their taxed revenue and boost their overall tax reimbursement.

Discovering Tax Obligation Credit Scores

Optimizing your tax obligation financial savings involves comprehending the different sorts of tax credit scores available to you. Tax credits directly lower your tax obligation obligation dollar for dollar, making them much more helpful than deductions, which only reduced your taxed earnings.

There site web are two key categories of tax obligation credit reports: nonrefundable and refundable. Nonrefundable credit histories can reduce your tax obligation obligation to zero yet will certainly not result in a reimbursement if the credit scores surpasses your tax obligation owed. Refundable credit scores, on the other hand, can create a refund even if you have no tax obligation obligation, making them specifically useful for lower-income taxpayers.

Usual tax credit ratings consist of the Earned Revenue Tax Credit (EITC), which sustains reduced to moderate-income working households and people, and the Kid Tax Obligation Credit rating, which provides financial alleviation for taxpayers with reliant children. Education-related credit scores, such as the American Chance Debt and the Life Time Discovering Credit rating, assistance counter the prices of college.

Typical Mistakes to Avoid

Navigating the intricacies of tax obligation returns can lead to a number of typical challenges that taxpayers should know. One considerable mistake is falling short to report all incomes. Even little amounts from sideline or freelance job must be included, as the IRS gets copies of all earnings statements.

An additional regular error includes ignoring reductions or credit scores for which one is eligible. Taxpayers need to thoroughly look into possible deductions, such as for student financings web or clinical expenditures, to avoid leaving cash on the table.

Additionally, errors in individual info, such as Social Safety numbers or filing standing, can delay processing and reimbursements. It is important to verify all information before submission to assure accuracy.

Declaring late or disregarding to file completely can also cause charges and missed opportunities for reimbursements. Taxpayers must recognize deadlines and plan as necessary.

Last but not least, lots of individuals neglect to maintain comprehensive documents of expenditures and supporting documents. Organized documents is essential for substantiating cases and helping with any future audits. By staying clear of these usual mistakes, taxpayers can simplify their filing procedure and enhance their potential refunds.

Tips for Maximizing Your Reimbursement

Next, take into consideration adding to retirement accounts, such as an IRA. Payments made prior to the tax obligation deadline can be subtracted, potentially boosting your refund. Additionally, if you are independent, make certain to represent business-related expenses that can minimize your taxed income.

One more vital strategy is to file your return electronically. E-filing not only accelerates the processing time however likewise reduces mistakes that can accompany paper entries. Furthermore, verify that you pick the proper filing status; this can considerably affect your tax obligation rate and qualification for sure credit scores.

Finally, keep careful documents throughout the year. Organizing receipts and financial documents can streamline the declaring process and help you determine prospective deductions that you might or else miss. By taking these steps, you place yourself to obtain the optimum refund possible.

Verdict

By methodically reporting income and leveraging review available deductions and debts, people can touch right into the potential for considerable tax reimbursements. For numerous, tax obligation returns are an entrance to possible reimbursements, as overpayment of tax obligations throughout the year can be redeemed, offering a much-needed financial increase.

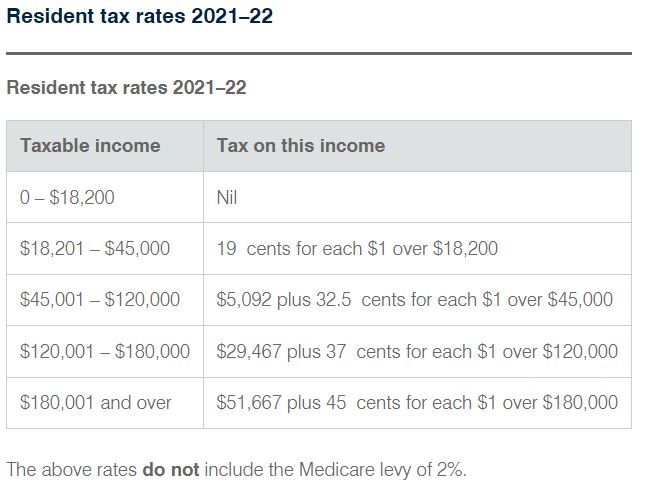

Understanding the numerous types of tax deductions readily available can greatly influence your overall tax liability. Online tax return Australia. By comprehending and leveraging tax deductions efficiently, taxpayers can lower their taxed revenue and boost their general tax refund

Report this page